Review of “A Peace to End All Peace”

This is a fantastic book. It covers the history of how the countries of the Middle East came to be, from the Great Game imperialist struggle between Britain and Russia in Asia (Fromkin has also written a great Foreign Affairs peace recounting that), to the Ottoman Empire’s two-front war during WWI where it somehow managed…

How Can We Heal the Crisis of Our Country’s Terrible Polarization?

Polarization is due to a simple thing: our voting system! The Founding Fathers did not desire nor expect political parties to form, particularly not a two-party system. After all, checks and balances between three branches of government do not work very effectively when one party is guaranteed control of 2/3 branches almost all of the…

Review of Votes from Seats

This is definitely a tour de force on how political science ought to be done. That being said, unless you are a political scientist or a student of political science, it might get a bit too detailed and mathy for your taste. But if you are in one of those two groups, I consider this book a…

How I Joined Cal RCV

I stared at the screen in disbelief and wonder. This was all so much more than I could have ever expected or hoped for! It was so plainly obvious to me now what I had to do. But, let me back up for a moment… It’s the early 2000s. I was a software engineer in…

The Overdue Withdrawal: a tragedy for Afghanistan and a relief for the U.S.

From a humanitarian standpoint, American failure in Afghanistan will have serious ramifications. As the Economist aptly puts it, “Afghans were left in such a horrifying bind that clinging to the wheels of a hurtling aircraft seemed their best option.” The human rights of many Afghans, particularly women, will be disregarded as the Taliban regime is…

Against Mandates, In Favor of Personal Responsibility

image via ImgFlip featuring characters from The Office. If you know my political leanings, it should be no surprise that I generally oppose government mandates or bans. One reason is that they often provoke a backlash. Social psychologist Robert Cialdini’s Psychology of Persuasion details numerous examples where people’s logical thinking switches off in favor of…

Understanding Critical Race Theory Through the Lens of Structural Determinism

The United States witnessed a renewed discussion on issues of racial discrimination, police brutality and criminal justice reform in the wake of George Floyd’s murder in May of last year. While a number of issues came to the public fore, one issue that amassed tremendous amount of attention was Critical Race Theory (CRT). CRT is…

What’s This Blog All About?

So, what is this blog all about? Quite simply, it will be aimed at exploring issues in as scientific a manner as possible to spark stimulating conversations and creating new connections and perhaps most importantly, to help me learn. Now, I know the subheader at the top of the page mentions policy commentary, and that…

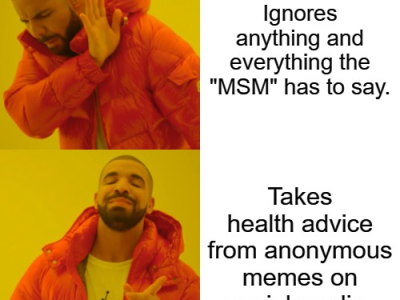

On the Reliability of the “MSM”

(image via imgflip) I often run across people who just completely dismiss mainstream media (MSM) as being completely unreliable. There is some merit to this perspective, but I think a better understanding of markets might help you get better results from your media sources. Let me explain. First of all, it’s key to keep in…

A Six-Step Program for Fiscally Conservative Social Liberals

A few years ago, the esteemed Chuck McGlawn argued against the temptation for libertarians to let someone pigeonhole our beliefs as being fiscally conservative and socially liberal. I do like his framing and also agree that it is important not to fall into the trap of letting our rather arcane and arbitrary two-party system dictate…

Loading…

Something went wrong. Please refresh the page and/or try again.

Follow My Blog

Get new content delivered directly to your inbox.